Abstract

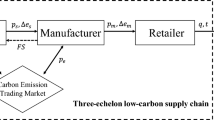

Based on the cap-and-trade regulation, the effect of retailer’s social responsibility and subsidy are analyzed in a two-level low-carbon supply chain. The government subsidizes manufacturer to encourage low-carbon technological innovation. It is gotten that both retailer’s social responsibility and subsidy can improve the profit of manufacturer and reduce the carbon emission level. Although more subsidies to manufacturer indeed may decrease the profit of retailer, it is good measure to promote the centralized decision-making between the retailer and manufacturer. A certain retailer’s social responsibilities are good for the carbon emission reduction, but it also brings about the decline of profit in the supply chain. The centralized decision-making is always the best choice strategy for the carbon emission reduction, while in the decentralized decision-making situation, the retailer has more possibilities to care about social responsibility.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.Notes

www.walmartsustainabilityhub.com Published online: 2X February 2023.

http: //www.wal-martchina.com

References

Linton, J.D., Klassen, R., Jayaraman, V.: Sustainable supply chains: an introduction. J. Oper. Manag. 25(6), 1075–1082 (2007)

Amaeshi, K., Osuji, O.K., Nnodim, P.: Corporate social responsibility in supply chains of global brands: A boundaryless responsibility? Clarifications, exceptions and implications. J. Bus. Ethics 81(1), 223–234 (2008)

Xu, X., He, P., Xu, H., Zhang, Q.: Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 183, 433–442 (2017)

Zhang, Y., Guo, C., Wang, L.: Supply chain strategy analysis of low carbon subsidy policies based on carbon trading. Sustainability 2(9), 3532 (2020)

Dong, C., Shen, B., Chow, P.S., Yang, L., Ng, C.T.: Sustainability investment under cap-and-trade regulation. Ann. Oper. Res. 240(2), 509–531 (2016)

Xie, X.P., Zhao, D.Z.: Research on cooperation strategy of enterprises’ carbon emission reduction in low carbon supply chain. J. Manag. Sci. 26(3), 108–119 (2013)

Brauneis, A., Mestel, R., Palan, S.: Inducing low-carbon investment in the electric power industry through a price floor for emissions trading. Energy Policy 53, 190–204 (2013)

Shoaeinaeini, M., Govindan, K., Rahmani, D.: Pricing policy in green supply chain design: the impact of consumer environmental awareness and green subsidies. Oper. Res. Int. J. 2021, 1–40 (2021)

Li, Z., Pan, Y., Yang, W., et al.: Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ. 101, 105426 (2021)

Li, Y., Zhao, D.: Research on R&D cost allocation comparison for low-carbon supply chain based on government’s subsidies. Soft Comput. 28, 21–26+31 (2014)

Xie, X.M., Zhu, Q.W., Wang, R.Y.: Turning green subsidies into sustainability: how green process innovation improves firms’ green image. Bus. Strateg. Environ. 28, 1416–1433 (2019)

Chen, W.T., Hu, Z.H.: Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 201, 123–141 (2018)

Cao, K.Y., Xu, X., Wu, Q., Zhang, Q.: Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J. Clean. Prod. 167, 505–513 (2017)

Hou, Q., Sun, J.Y.: Investment strategy analysis of emission-reduction technology under cost subsidy policy in the carbon trading market. Kybernetes 49, 252–284 (2019)

Hussain, J., Pan, Y., Ali, G., Yue, X.: Pricing behavior of monopoly market with the implementation of green technology decision under emission reduction subsidy policy. Sci. Total Environ. 709, 136110 (2020)

Hutchinson, E., Kennedy, P.W., Martinez, C.: Subsidies for the production of cleaner energy: when do they cause emissions to rise? J. Econ. Anal. Policy 10(1), 1–9 (2010)

Chen, J.Y., Dimitrov, S., Pun, H.: The impact of government subsidy on supply Chains’ sustainability innovation. Omega Int. J. Manag. Sci. 86, 42–58 (2019)

Choi, T.M., Cai, Y.J., Shen, B.: Sustainable fashion supply chain management: a system of systems analysis. IEEE Trans. Eng. Manage. 66(4), 730–745 (2019)

Shen, B., Zhu, C., Li, Q., Wang, X.: Green technology adoption in textiles and apparel supply chains with environmental taxes. Int. J. Prod. Res. 59(14), 4157–4174 (2020)

Cao, Y., Shen, B.: Adopting Blockchain Technology to Block Less Sustainable Products’ Entry in Global Trade. Transp. Res. Part E Logist. Transp. Rev. 161, 102695 (2022)

Ebrahimi, S., Hosseini-Motlagh, S.M., Nematollahi, M., Cárdenas-Barrón, L.E.: Coordinating double-level sustainability effort in a sustainable supply chain under cap-and-trade regulation. Expert Syst. Appl. 207, 117872 (2022)

Ni, D., Li, K.W., Tang, X.: Social responsibility allocation in two-echelon supply chains: insights from wholesale price contracts. Eur. J. Oper. Res. 207(3), 1269–1279 (2010)

Nematollahi, M., Hosseini-Motlagh, S.M., Heydari, J.: Coordination of social responsibility and order quantity in a two-echelon supply chain: a collaborative decision-making perspective. Int. J. Prod. Econ. 184, 107–121 (2017)

Ni, D., Li, K.W.: A game-theoretic analysis of social responsibility conduct in two-echelon supply chains. Int. J. Prod. Econ. 138(2), 303–313 (2012)

Goering, G.E.: Corporate social responsibility and marketing channel coordination. Res. Econ. 66(2), 142–148 (2012)

Panda, S.: Coordination of a socially responsible supply chain using revenue sharing contract. Transp. Res. Part E Logist. Transp. Rev. 67, 92–104 (2014)

Hsueh, C.F.: Improving corporate social responsibility in a supply chain through anew revenue sharing contract. Int. J. Prod. Econ. 151, 214–222 (2014)

Panda, S., Modak, N., Basu, M., Goyal, S.: Channel coordination and profit distribution in a social responsible three-layer supply chain. Int. J. Prod. Econ. 168, 224–233 (2015)

Zhou, Y., Hu, F., Zhou, Z.: Pricing decisions and social welfare in a supply chain with multiple competing retailers and carbon tax policy. J. Clean. Prod. 190, 752–777 (2018)

Shen, B., Gao, Y., Xu, X., Wang, X.: Product line design and quality differentiation for green and non-green products in a supply chain. Int. J. Prod. Res. 58(1), 148–164 (2019)

Shen, B., Liu, S., Zhang, T., Choi, T.M.: Optimal advertising and pricing for new green products in the circular economy. J. Clean. Prod. 233, 314–327 (2019)

Shen, B., Choi, T.M., Chan, H.L.: Selling green first or not? A Bayesian analysis with service levels and environmental impact considerations in the big data era. Technol. Forecast. Soc. Chang. 144, 412–420 (2019)

Qb, A., Mc, B., Yn, C., et al.: Improving sustainability and social responsibility of a two-tier supply chain investing in emission reduction technology. Appl. Math. Model. 95, 688–714 (2021)

Geffen, C.A., Rothenberg, S.: Suppliers and environmental innovation the automotive paint process. Int. J. Oper. Prod. Manag. 20(2), 166–186 (2000)

Klassen, R.D., Vachon, S.: Collaboration and evaluation in the supply chain: the impact on plant-level environmental investment. Prod. Oper. Manag. 12(3), 336–352 (2003)

Vachon, S., Klassen, R.D.: Environmental management and manufacturing performance: the role of collaboration in the supply chain. Int. J. Prod. Econ. 111(2), 299–315 (2008)

Zhu, Q., Geng, Y., Lai, K.H.: Circular economy practices among Chinese manufacturers varying in environmental-oriented supply chain cooperation and the performance implications. J. Environ. Manage. 91(6), 1324–1331 (2010)

Luo, Z., Chen, X., Wang, X.: The role of co-opetition in low carbon manufacturing. Eur. J. Oper. Res. 253(2), 392–403 (2016)

Shen, B., Ding, X., Chen, L., Chan, H.L.: Low carbon supply chain with energy consumption constraints: case studies from china’s textile industry and simple analytical model. Supply Chain Manag. Int. J. 22(3), 258–269 (2017)

Meng, W.: Comparation of subsidy and cooperation policy based on emission reduction R&D. Syst. Eng. 28, 123–126 (2010)

Song, Y., Zhao, D.Z.: The product portfolio optimization of manufacturers based on low-carbon economy. Syst. Eng. 30, 75–81 (2012)

Mondal, C., Giri, B.C., Biswas, S.: Integrating corporate social responsibility in a closed-loop supply chain under government subsidy and used products collection strategies. Flex. Serv. Manuf. J. 8, 1–36 (2021)

Sinayi, M., Rasti-Barzoki, M.: A game theoretic approach for pricing, greening, and social welfare policies in a supply chain with government intervention. J. Clean. Prod. 196, 1443–1458 (2018)

Wen, X., Sun, X., Sun, Y., Yue, X.: Airline crew scheduling: models and algorithms. Transp. Res. Part E Logist. Transp. Review 149, 102304 (2021)

Acknowledgements

The authors are grateful to the editor and the reviewers for their help comments and suggestions, which have improved the presentation of the paper.

Author information

Authors and Affiliations

Contributions

This article has been composed by P. Wang, X.-H. Y, and Q. Zhang. All three authors have read and agreed to the published this version of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

P. Wang, X.-H. Yu, and Q. Zhang declare no conflict of interest.

Additional information

This research was funded by the National Natural Science Foundation of China (Nos. 72171024 and 71801016), in part by 2022 annual project of the Beijing Municipal Education Commission’s support plan for the construction of the faculty of Beijing municipal universities (No. BPHR202203154), the Beijing Municipal Commissions and Offices Foundation of China (No. 2019Z005-001-KWY), and E-commerce Teaching Innovation Team (No. CJGX2022-026–002).

Appendices

Appendix A

Proof of Theorem 1.

At the second stage, the retailer sets the retrial price to maximize its profit function, then

By Eq. (A1), \(\frac{{\partial \pi_{{\text{R}}} }}{\partial p} = a - \gamma \left( {e_{0} - e} \right) + \beta w - 2\beta p\), let it equal zero, the solution is \(p^{ * } = {a \mathord{\left/ {\vphantom {a {2\beta }}} \right. \kern-0pt} {2\beta }} + {w \mathord{\left/ {\vphantom {w 2}} \right. \kern-0pt} 2} - {{\gamma \left( {e_{0} - e} \right)} \mathord{\left/ {\vphantom {{\gamma \left( {e_{0} - e} \right)} {2\beta }}} \right. \kern-0pt} {2\beta }}\), while \(\frac{{\partial^{2} \pi_{{\text{R}}} }}{{\partial p^{2} }} = - 2\beta < 0\). At the second stage, the manufacturer sets carbon emission and the wholesale price for their products to maximize its utility function, then

Pugging \(p^{ * }\) into manufacturer’s profit function \(\pi_{{\text{M}}}\), we get that

Let the Hessian matrix of profit function be denoted by \(H_{{\pi_{{\text{M}}} }}\). Primary sub formula of first order sequence \({\text{Det}}(H_{{\pi_{{\text{M}}} ,1}} ) = - \lambda { + }\gamma p_{e}\), and the primary sub formula of second order sequence \({\text{Det}}(H_{{\pi_{{\text{M}}} ,2}} ) = \beta \left( {\lambda - \gamma p_{e} } \right) - {{\left( {\gamma - p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\gamma - p_{e} \beta } \right)^{2} } 4}} \right. \kern-0pt} 4}\). When \({{\lambda \geqslant \left( {\gamma - p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\lambda \geqslant \left( {\gamma - p_{e} \beta } \right)^{2} } {4\beta }}} \right. \kern-0pt} {4\beta }}{ + }\gamma p_{e} = {{\left( {\gamma { + }p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\gamma { + }p_{e} \beta } \right)^{2} } {4\beta }}} \right. \kern-0pt} {4\beta }}\), \({\text{Det}}(H_{{\pi_{{\text{M}}} ,2}} ) \geqslant 0\) and \({\text{Det}}(H_{{\pi_{{\text{M}}} ,1}} ) = - \lambda { + }\gamma p_{e} \leqslant 0\). Therefore, \(H_{{\pi_{{\text{M}}} }}\) is negative definite. The first-order conditions are

So

where \(\Delta { = 4}\lambda \beta - \left( {\gamma { + }p_{e} \beta } \right)^{2}\), \(\eta_{1} = \gamma { + }p_{e} \beta\) and \(\eta_{2} = \gamma - p_{e} \beta\).

Proof of Proposition 1

By Eq. (3), there are

By Eq. (5), it is gotten that

so \(p_{e} \geqslant\) \({\gamma \mathord{\left/ {\vphantom {\gamma {3\beta }}} \right. \kern-0pt} {3\beta }}\), \(\frac{{\partial p^{ * } }}{\partial \lambda } \geqslant\) 0.

Proof of Proposition 2

Without subsidy and customer surplus, the demand is

Also, the profits of retailer and manufacturer are

Furthermore, the whole profit of SC is

By Eqs. (A3), (A4), (A5) and (A6), we have that

Furthermore, as \(\pi_{{\text{S}}}^{*} = \pi_{{\text{M}}}^{*} + \pi_{{\text{R}}}^{*}\), we get that

Proof of Theorem 2

When the cooperation is structured in the SC, the retailer and manufacturer set the carbon emission and price together to maximize the profit of SC, so

Let the Hessian matrix of profit function be denoted by \(H_{{\pi_{{\text{s}}} }}\). Primary sub formula of first order sequence \({\text{Det}}(H_{{\pi_{{\text{S}}} ,1}} ) = - \lambda { + 2}\gamma p_{e}\), and the primary sub formula of second order sequence \({\text{Det}}(H_{{\pi_{{\text{S}}} ,2}} ) = 2\beta \lambda - \left( {\gamma + p_{e} \beta } \right)^{2}\). When \({{\lambda \geqslant \left( {\gamma { + }p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\lambda \geqslant \left( {\gamma { + }p_{e} \beta } \right)^{2} } {2\beta }}} \right. \kern-0pt} {2\beta }}\), \({\text{Det}}(H_{{\pi_{{\text{S}}} ,2}} ) \geqslant 0\) and \({\text{Det}}(H_{{\pi_{{\text{S}}} ,1}} ) = - \lambda { + 2}\gamma p_{e} \leqslant 0\). Therefore, \(H_{{\pi_{{\text{S}}} }}\) is negative definite. The first-order conditions are

So

where \(\Delta { = 4}\lambda \beta - \left( {\gamma { + }p_{e} \beta } \right)^{2}\), \(\eta_{1} = \gamma { + }p_{e} \beta\) and \(\eta_{2} = \gamma - p_{e} \beta\).

Proof of Proposition 3

Comparing Theorem 1 and 2, we get \(e^{{**}} \geqslant\) \(e^{*}\) directly. Moreover, under the condition of centralized decision-making, the market demand is

Then we have that \(D^{{**}} \geqslant D^{*}\). Furthermore, it is seen that

So by Eq. (A6), we have that

Therefore, we obtain that \(\pi_{{\text{S}}}^{**} \geqslant \pi_{{\text{S}}}^{*}\).

Appendix B

Proof of Theorem 3

At the second stage, the retailer sets the retrial price to maximize its utility function, then

By Eq. (B1), \(\frac{{\partial v_{{\text{R}}} }}{\partial p} = \left( {1 - \beta u} \right)a - \left( {1 - \beta u} \right)\gamma \left( {e_{0} - e} \right) + \beta w - \beta \left( {2 - \beta u} \right)p\), let it be equal zero, the solution is

while \(\frac{{\partial^{2} v_{{\text{R}}} }}{{\partial p^{2} }} = - 2\beta { + }u\beta < 0\). At the first stage, the manufacturer sets the carbon emission reduction level and the wholesale price to maximize its utility function, then

Pugging \(p^{c * }\) into manufacturer’s profit function \(\pi_{M}\):

Let the Hessian matrix of profit function be denoted by \(H_{{\pi_{{\text{M}}} }}\). Primary sub formula of first order sequence \({\text{Det}}(H_{{{\pi_{{\text{M}}} }}_{,1}} ) = - \lambda + {{2\gamma p_{e} } \mathord{\left/ {\vphantom {{2\gamma p_{e} } {\left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\left( {2 - \beta u} \right)}}\), and the primary sub formula of second order sequence \({\text{Det}}(H_{{\pi_{{\text{M}}} ,2}} ) = {{2\beta } \mathord{\left/ {\vphantom {{2\beta } {\left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\left( {2 - \beta u} \right)}}\left( {\lambda - {{2\gamma p_{e} } \mathord{\left/ {\vphantom {{2\gamma p_{e} } {\left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\left( {2 - \beta u} \right)}}} \right) - {{\left( {\gamma - p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\gamma - p_{e} \beta } \right)^{2} } {\left( {2 - \beta u} \right)^{2} }}} \right. \kern-0pt} {\left( {2 - \beta u} \right)^{2} }}\). When \({{\lambda \geqslant \left( {\gamma - p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\lambda \geqslant \left( {\gamma - p_{e} \beta } \right)^{2} } {2\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {2\beta \left( {2 - \beta u} \right)}}{ + }{{2\gamma p_{e} } \mathord{\left/ {\vphantom {{2\gamma p_{e} } {\left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\left( {2 - \beta u} \right)}} = {{\left( {\gamma { + }p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\gamma { + }p_{e} \beta } \right)^{2} } {2\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {2\beta \left( {2 - \beta u} \right)}}\) and \(u \leqslant \min \left\{ {1,\;{2 \mathord{\left/ {\vphantom {2 {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta \lambda }}} \right. \kern-0pt} {4\beta \lambda }}}}} \right. \kern-0pt} {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta \lambda }}} \right. \kern-0pt} {4\beta \lambda }}}}} \right\}\), \({\text{Det}}(H_{{\pi_{{\text{M}}} ,2}} ) \geqslant 0\) and \({\text{Det}}(H_{{\pi_{{\text{M}}} ,1}} ) \leqslant 0\). Therefore, \(H_{{\pi_{{\text{M}}} }}\) is negative definite. The first-order conditions are

So we have that

where \(\Delta^{c} = 2\beta \lambda \left( {2 - \beta u} \right) - \left( {\gamma + p_{e} \beta } \right)^{2}\).

Proof of Proposition 4

Compared Theorem 1 and 3, it is seen that \(e^{c*} \geqslant\) \(e^{*}\), \(w^{c*} \geqslant\) \(w^{*}\) and \(p^{c*} \geqslant\) \(p^{*}\). With retailer’s CSR, the market demand is

where \(\Delta^{c} = 2\beta \lambda \left( {2 - \beta u} \right) - \left( {\gamma + p_{e} \beta } \right)^{2}\). By Eq. (6), the market demand without retailer’s CSR is \(D^{*} = {{\beta \lambda \left( {a - \eta_{1} e_{0} } \right)} \mathord{\left/ {\vphantom {{\beta \lambda \left( {a - \eta_{1} e_{0} } \right)} \Delta }} \right. \kern-0pt} \Delta },\) where \(\Delta { = 4}\lambda \beta - \left( {\gamma { + }p_{e} \beta } \right)^{2}\). It is gotten that \(\Delta^{c} \leqslant\) \(\Delta\), so \(D^{c*} \geqslant\) \(D^{*}\). With retailer’s CSR, the profit of manufacturer is obtained,

Without Retailer’s CSR, by Eqs. (A4) and (A5), the profit of manufacturer is

It is not hard to get that \(\pi_{{\text{M}}}^{c*} \geqslant\) \(\pi_{{\text{M}}}^{*}\) when \(u \leqslant \min \left\{ {1,\;{2 \mathord{\left/ {\vphantom {2 {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta^{{2}} \lambda }}} \right. \kern-0pt} {4\beta^{{2}} \lambda }}}}} \right. \kern-0pt} {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta^{{2}} \lambda }}} \right. \kern-0pt} {4\beta^{{2}} \lambda }}}}} \right\}\).

Proof of Theorem 4

When a cooperation is structured in the SC, the retailer and manufacturer set the carbon emission level and retail price to maximize the utility of SC, then

Let the Hessian matrix of profit function be denoted by \(H_{{v_{{\text{s}}} }}\). Primary sub formula of first order sequence \({\text{Det}}(H_{{v_{{\text{S}}} ,1}} ) = - \lambda { + 2}\gamma p_{e} { + }\gamma u\), and the primary sub formula of second order sequence is

\({\text{Det}}(H_{{\pi_{{\text{M}}} ,2}} ) = \frac{2\beta }{{2 - \beta u}}\left( {\lambda - \frac{{2\gamma p_{e} { + }\gamma u}}{2 - \beta u}} \right) - \frac{{\left( {\gamma - p_{e} \beta - \beta u\gamma } \right)^{2} }}{{\left( {2 - \beta u} \right)^{2} }}\).

Because \(u \leqslant \min \left\{ {1,\;{2 \mathord{\left/ {\vphantom {2 {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta \lambda }}} \right. \kern-0pt} {4\beta \lambda }}}}} \right. \kern-0pt} {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta \lambda }}} \right. \kern-0pt} {4\beta \lambda }}}}} \right\}\), it is gotten that \({{\lambda \geqslant \left( {\gamma + p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\lambda \geqslant \left( {\gamma + p_{e} \beta } \right)^{2} } {2\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {2\beta \left( {2 - \beta u} \right)}}\) and \(u \leqslant \min \left\{ {1,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta }} \right\}\). Thus, we get \({\text{Det}}(H_{{v_{{\text{S}}} ,2}} ) \geqslant 0\) and \({\text{Det}}(H_{{v_{S} ,1}} ) \leqslant 0\). Therefore, \(H_{{v_{{\text{S}}} }}\) is negative definite. The first-order conditions are

So we have that

where \(\eta_{1} = \gamma { + }p_{e} \beta\) and \(\eta_{2} = \gamma - p_{e} \beta\).

Proof of Proposition 5

It is not hard to get that \(e^{c**} \geqslant\) \(e^{**}\) when \(u \leqslant \min \left\{ {1,\;{2 \mathord{\left/ {\vphantom {2 {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta \lambda }}} \right. \kern-0pt} {4\beta \lambda }}}}} \right. \kern-0pt} {\beta ,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta } - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {4\beta \lambda }}} \right. \kern-0pt} {4\beta \lambda }}}}} \right\}\). Also, by Eqs. (3) and (17), we have that

Therefore, it is obtained that \(e^{**} \geqslant\) \(e^{c*} \geqslant\) \(e^{*}\) because that \(2 - \beta u \geqslant\) 1. Similarly, it is proved that \(D^{c**} \geqslant\) \(D^{**} \geqslant\) \(D^{c*} \geqslant\) \(D^{*}\).

Proof of Proposition 6

By Proposition 4, it is not hard to have that \(\pi_{{\text{S}}}^{{**}} \geqslant\) \(\pi_{{\text{S}}}^{*}\), since \(\pi_{{\text{R}}}^{c*} \geqslant\) \(\pi_{{\text{R}}}^{*}\) and \(\pi_{{\text{M}}}^{c*} \geqslant\) \(\pi_{{\text{M}}}^{*}\). Meanwhile, considering the CSR, the total profit of SC in the decentralized decision making situation is

Thus, we have that

As

it is gotten the conclusion that \(\pi_{{\text{S}}}^{{c{**}}} \geqslant\) \(\pi_{{\text{S}}}^{c*}\).

Proof of Theorem 5

At the second stage, the retailer sets the retrial price to maximize its utility function, then

By Eq. (B4), \(\frac{{\partial v_{{\text{R}}} }}{\partial p} = \left( {1 - \beta u} \right)a - \left( {1 - \beta u} \right)\gamma \left( {e_{0} - e} \right) + \beta w - \beta \left( {2 - \beta u} \right)p\), let it be equal zero, the solution is

while \(\frac{{\partial^{2} v_{{\text{R}}} }}{{\partial p^{2} }} = - 2\beta { + }u\beta < 0\). At the first stage, the manufacturer sets carbon emission and the wholesale price for their products to maximize its utility function, then

Pugging \(p^{s * }\) into M’s profit function \(\pi_{M}\):

Let the Hessian matrix of profit function be denoted by \(H_{{\pi_{{\text{M}}} }}\). Primary sub formula of first order sequence \({\text{Det}}(H_{{{\pi_{{\text{M}}} }}_{,1}} ) = - \left( {\lambda - \theta } \right) + {{2\gamma p_{e} } \mathord{\left/ {\vphantom {{2\gamma p_{e} } {\left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\left( {2 - \beta u} \right)}}\), and the primary sub formula of second order sequence

When

\({\text{Det}}(H_{{\pi_{{\text{M}}} ,2}} ) \geqslant 0\) and \({\text{Det}}(H_{{\pi_{{\text{M}}} ,1}} ) \leqslant 0\). Therefore, \(H_{{\pi_{{\text{M}}} }}\) is negative definite. The first-order conditions are

So

where \(\Delta^{s} = 2\beta \left( {\lambda - \theta } \right)\left( {2 - \beta u} \right) - \left( {\gamma + p_{e} \beta } \right)^{2}\).

Proof of Lemma 1

As

it is gotten that \(f{(}x{)}\) is concave function. Hence, we do not repeat it here.

Proof of Theorem 6

With the subsidy, the market demand in the decentralized making decision situation \(D^{s * }\) is

Thus, the profits and manufacturer and retailer are

By Lemma 1, if \(\theta = \lambda - {{\left( {\gamma + p_{e} \beta } \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\gamma + p_{e} \beta } \right)^{2} } {\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\beta \left( {2 - \beta u} \right)}}\), then \(\pi_{{\text{R}}}^{s * }\) gets its minimum value, and

Therefore, the conclusion is gotten.

Proof of Theorem 7

When a cooperation is structured in the SC, retailer and manufacturer set the carbon emission level and retail price to maximize the utility of SC, and

Let the Hessian matrix of profit function be denoted by \(H_{{v_{s} }}\). Primary sub formula of first order sequence \({\text{Det}}(H_{{v_{{\text{S}}} ,1}} ) = - \left( {\lambda - \theta } \right){ + 2}\gamma p_{e} { + }\gamma u\), and the primary sub formula of second order sequence \({\text{Det}}(H_{{v_{{\text{S}}} ,2}} ) = 2\beta \left( {\lambda - \theta } \right) - \left( {\gamma + p_{e} \beta } \right)^{2}\). When \(\theta \leqslant \lambda - {{\left( {\gamma - p_{e} \beta + \gamma u} \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\gamma - p_{e} \beta + \gamma u} \right)^{2} } {\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\beta \left( {2 - \beta u} \right)}} - \gamma \left( {u + 2p_{e} } \right)\) and \(u \leqslant \min \left\{ {1,\;{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta }} \right\}\), we get that \({\text{Det}}(H_{{v_{{\text{S}}} ,2}} ) \geqslant\) 0 and \({\text{Det}}(H_{{v_{{\text{S}}} ,1}} ) \leqslant 0\). Therefore, \(H_{{v_{{\text{S}}} }}\) is negative definite. The first-order conditions are

So

where \(\eta_{1} = \gamma { + }p_{e} \beta\) and \(\eta_{2} = \gamma - p_{e} \beta\).

Proof of Proposition 7

-

(1)

As the coefficient a is big enough, we have that

$$\begin{aligned} \frac{{\partial e^{*} }}{\partial \gamma } & = \frac{{a\eta_{1}^{2} + 2\beta (a - 2e_{0} \eta_{1} ) \cdot 2\lambda }}{{\Delta^{2} }} \geqslant 0,\;\;\;\frac{{\partial e^{*} }}{{\partial p_{e} }} = \frac{{a\eta_{1}^{2} + 2\beta (a - 2e_{0} \eta_{1} ) \cdot 2\lambda }}{{\Delta^{2} }}\beta \geqslant 0 \\ \frac{{\partial e^{**} }}{\partial \gamma } & = \frac{{a\eta_{1}^{2} + \beta (a - 2e_{0} \eta_{1} ) \cdot 2\lambda }}{{(2\lambda \beta - \eta_{1}^{2} )^{2} }} \geqslant 0,\;\;\;\frac{{\partial e^{**} }}{{\partial p_{e} }} = \frac{{a\eta_{1}^{2} + \beta (a - 2e_{0} \eta_{1} ) \cdot 2\lambda }}{{\Delta^{2} }}\beta \geqslant 0. \\ \end{aligned}$$ -

(2)

As \(u \leqslant \min \{ 1,{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta }\}\), we get that

$$\begin{aligned} \frac{{\partial e^{c*} }}{\partial \gamma } & = \frac{{a\eta_{1}^{2} + 2\beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)\lambda }}{{(\Delta^{c} )^{2} }} \geqslant 0,\\ \frac{{\partial e^{c*} }}{{\partial p_{e} }} &= \frac{{a\eta_{1}^{2} + 2\beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)\lambda }}{{(\Delta^{c} )^{2} }}\beta \geqslant 0, \\ \frac{{\partial e^{c**} }}{\partial \gamma } & = \frac{{a\eta_{1}^{2} + \beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)\lambda }}{{(\lambda \beta (2 - \beta u) - \eta_{1}^{2} )^{2} }} \geqslant 0,\\ \frac{{\partial e^{c**} }}{{\partial p_{e} }}& = \frac{{a\eta_{1}^{2} + \beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)\lambda }}{{(\lambda \beta (2 - \beta u) - \eta_{1}^{2} )^{2} }}\beta \geqslant 0. \\ \end{aligned}$$ -

(3)

Due to \(u \leqslant \min \{ 1,{2 \mathord{\left/ {\vphantom {2 \beta }} \right. \kern-0pt} \beta }\}\) and \(\theta \leqslant \lambda - {{\eta_{1}^{2} } \mathord{\left/ {\vphantom {{\eta_{1}^{2} } {2\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {2\beta \left( {2 - \beta u} \right)}}\), we obtain that

$$\begin{aligned} \frac{{\partial e^{s*} }}{\partial \gamma } & = \frac{{a\eta_{1}^{2} + 2\beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)(\lambda - \theta )}}{{(\Delta^{s} )^{2} }} \geqslant 0, \\ \frac{{\partial e^{s*} }}{{\partial p_{e} }} & = \frac{{a\eta_{1}^{2} + 2\beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)(\lambda - \theta )}}{{(\Delta^{s} )^{2} }}\beta \geqslant 0, \\ \frac{{\partial e^{s**} }}{\partial \gamma } & = \frac{{a\eta_{1}^{2} + \beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)(\lambda - \theta )}}{{((\lambda - \theta )\beta (2 - \beta u) - \eta_{1}^{2} )^{2} }} \geqslant 0, \\ \frac{{\partial e^{s**} }}{{\partial p_{e} }} & = \frac{{a\eta_{1}^{2} + \beta (a - 2e_{0} \eta_{1} ) \cdot (2 - \beta u)(\lambda - \theta )}}{{((\lambda - \theta )\beta (2 - \beta u) - \eta_{1}^{2} )^{2} }}\beta \geqslant 0. \\ \end{aligned}$$

Proof of Theorem 8

With the subsidy, the whole profit of SC in the centralized decision-making situation is

The utility of SC in the centralized decision-making situation is

By Remark 2, there is

so \(v_{{\text{S}}}^{s**} \leqslant v_{{\text{S}}}^{c**}\). The profit of supply in decentralized decision-making situation is

Hence, it is obvious that \(\pi_{{\text{S}}}^{s**} \geqslant \pi_{{\text{S}}}^{s*}\). Also, the utility of supply in decentralized decision-making situation is

Thus, we have that

It is gotten that \(\pi_{{\text{S}}}^{s**} - \pi_{{\text{S}}}^{s*} \geqslant\) \(\pi_{{\text{S}}}^{c**} - \pi_{{\text{S}}}^{c*}\). This proof is completed.

Proof of Theorem 9

The proof is similar to Theorem 6. When the subsidy is at a certain point \(\theta = \lambda - {{\left( {\eta_{2} + \gamma u} \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\eta_{2} + \gamma u} \right)^{2} } {\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\beta \left( {2 - \beta u} \right)}} - \gamma \left( {u + 2p_{e} } \right)\), the profit of the SC is the smallest. Because \(\lambda - {{\left( {\eta_{2} + \gamma u} \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\eta_{2} + \gamma u} \right)^{2} } {\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\beta \left( {2 - \beta u} \right)}} - \gamma \left( {u + 2p_{e} } \right) \leqslant \lambda - {{\left( {\eta_{2} + \gamma u} \right)^{2} } \mathord{\left/ {\vphantom {{\left( {\eta_{2} + \gamma u} \right)^{2} } {\beta \left( {2 - \beta u} \right)}}} \right. \kern-0pt} {\beta \left( {2 - \beta u} \right)}} - \gamma \left( {u + 2p_{e} } \right)\), so \(\frac{{\partial \pi_{{\text{S}}}^{{s{*}*}} }}{\partial \theta } \leqslant 0\).

Proof of Theorem 10

We have gotten that

Because \(\Delta^{s} = 2\beta \left( {\lambda - \theta } \right)\left( {2 - \beta u} \right) - \left( {\gamma + p_{e} \beta } \right)^{2} \leqslant 2\beta \lambda \left( {2 - \beta u} \right) - \left( {\gamma + p_{e} \beta } \right)^{2} = \Delta^{c}\), so we also get that \(e^{s**} \geqslant e^{c**}\) and \(e^{s*} \geqslant e^{c*}\). By Proposition 5, we get that \(D^{c**} \geqslant D^{**} \geqslant D^{c*}\). In a similar way, it is obtained that \(D^{s**} \geqslant D^{s*} \geqslant D^{c*} \geqslant D^{*}\). Hence, we only need to prove that \(D^{c**} \geqslant D^{s*}.\)

Furthermore, we have that

Thus, it is gotten that

\(D^{{c{\text{**}}}} - D^{{s * }} = \beta \left( {a - \eta _{1} e_{0} } \right)\left( {\frac{1}{{\beta \left( {2 - \beta u} \right) - \eta _{1} ^{2} /\lambda }} - \frac{1}{{2\beta \left( {2 - \beta u} \right) - \eta _{1} ^{2} /\left( {\lambda - \theta } \right)}}} \right) \geqslant 0.\)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, P., Yu, XH. & Zhang, Q. The Effect of Retailer’ Social Responsibility and Government Subsidy on the Performance of Low-Carbon Supply Chain. J. Oper. Res. Soc. China 13, 227–267 (2025). https://doi.org/10.1007/s40305-023-00479-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40305-023-00479-z